On Wednesday 18th January 2017, the PMRC research team appeared before the Parliamentary Committee on Estimates to discuss “Fiscal Decentralisation” in Zambia and potential budgetary changes to promote service delivery. The submission and discussions focused on understanding the concept of Fiscal decentralisation, assessing the status of sub-national authorities and also analyzing possible institutional and budgetary changes in light of decentralisation.

The following are major highlights from the PMRC submission;

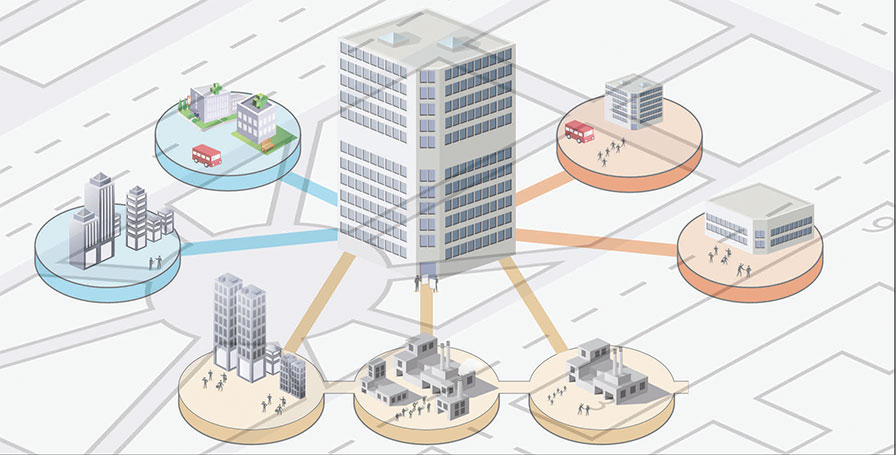

The main aim of the Decentralization Policy 2013 is to promote people’s participation in democratic governance at the local level. It is important to note that not all functions would be transferred to the lower levels and councils, but that Central Government shall retain some core functions over essential national matters.

Focusing on Decentralisation Policy Implementation progress, it was noted that: The transfer of functions from Central Government to Councils commenced in January 2015 and, apart from devolving functions, the Cabinet Circular also mandated Councils to create “Ward Development Committees (WDCs)” as the fourth tier of Government as required in the Revised National Decentralisation Policy (R-NDP) then. In view of this, the National Planning and Budgetary Policy states that Districts will be required to submit District Development Plans (PDP), which will be forwarded to the province and feed into the Provincial Development Plan. The province will then send the PDP to the Ministry of Finance .

Capacity Issues: The Reality of Fiscal Decentralisation (The need to Strengthen Capacity)

- For sub national and local authorities to supervise their many new functions previously undertaken by Central Government, they will require massive capacity building and recruitment of top-level high quality administrators. The challenge therefore for the Central Government is to ensure that adequate resources are made available to all implementing institutions.

- District and sub-district level community structures would also need strengthening to fully appreciate decentralization and the levels of civic responsibilities that the local communities now need to play.

- The general citizenry further needs capacity building for them to effectively participate in the affairs and running of their local district and sub-district level authorities.

The Creation Of New Districts

The discussion around the creation of new districts bordered on; Government expediting the infrastructure, institutional and financial resources to ensure that the new districts are equipped with all requirements necessary to implement tasks.

LESSONS FROM BEST PRACTICE – the case of South Africa

Fiscal decentralisation in South Africa involves shifting some responsibilities for both revenue and expenditure to sub-national levels of government. Based on the “Division of Revenue Act”, which annually allocates national revenues to each of the three spheres of government, the South African Intergovernmental Fiscal System (IGFR) provides a framework of fiscal arrangements aimed at ensuring that government responsibilities are met, while the right level and mix of public services are delivered to enhance the socioeconomic rights of citizens.

PMRC proposed to the committee that the Zambian Government should seriously consider learning from the South African framework in implementing fiscal decentralization.

SUMMARY OF LESSONS LEARNT

In learning from best practice, the following are some of the key points noted to aid effective decentralisation implementation:

- Conducive policy environment: there should be conducive policy environment which sub divides mandates and sub national authorities, clearly establishing tasks and roles.

- Phased approach: Decentralisation is a long-term process that needs to be planned for and undertaken in stages. (for example: Uganda and Kenya had a series of pilot projects in reference to decentralization.)

- Proactive and practicality of implementation: Ensuring that decentralisation is implemented in practice. There should be political will and commitment.

- Matching plans to resources: Resource allocation and mobilization has been highlighted as a key requirement for the effective implementation of plans.

- Capacity building: for efficient and effective resource management and decision making.

CONCLUSION

Experience has clearly shown that effective decentralization requires complementary adaptations in institutional arrangements for intergovernmental coordination, planning, budgeting, financial reporting, and implementation. Of utmost importance is transparency and accountability to local constituencies supported by strengthened higher level monitoring and reporting of local fiscal performance. PMRC affirms that with effective implementation, well-defined responsibilities, definite functions, and distinct lines of authority and communication, Government may attain the set objectives of increased community participation and improved service delivery through decentralisation.

PMRC RECOMMENDATIONS

Policymakers should take the following observations into account:

- Financial decentralisation should not be used as a means for national governments to shift the burden of financing services to sub-national governments and private providers. (The mandate should be clearly outlined)

- Fiscal decentralisation requires citizen participation since resource allocations should reflect local preferences. The challenge is to overcome the technical complexity of the process and find appropriate ways to institutionalize participation. (The case of checks and balances)

- Further, steps to enhance service delivery by sub-national authorities need to focus more sharply on coherent policies targeted towards outcomes. (The case of the 7 National Development Plan)

- Strengthen accountability mechanisms to prevent corruption and misappropriation of funds as fiscal decentralisation is being implemented.