By Emmanuel Mumba – PMRC Research Assistant

The economic prospect for Zambia is in recovery mode, having experienced a wave of financial and economic deterioration in the last decades, which, together with the adverse effects of the COVID-19 pandemic, that saw the country default on its Euro bond payments in 2020. The World Bank projects the economy to grow by 3.8% between 2022 to 2024. Critical to this projection which forms the basis of this article, include; a stable macroeconomic framework, predictable mining regime, positive copper price outlook, improved balance of payments and trade openness.

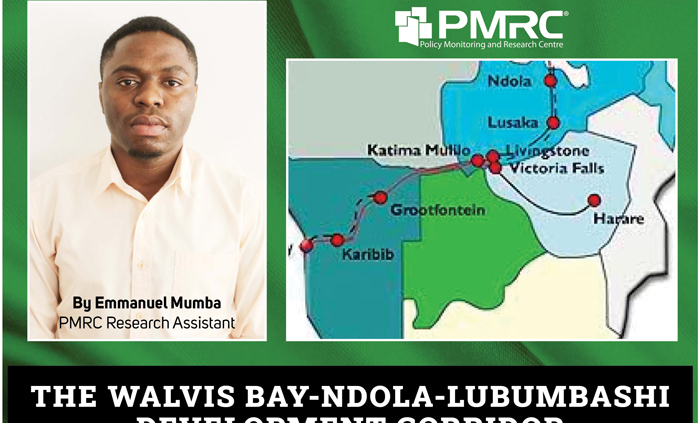

It is well documented that Zambia is comparatively located geographically. However, the country has not advanced itself to realise this potential. Against this background, the government has embarked on an economic agenda to reconfigure the country’s growth framework and has identified regional economic linkages as critical drivers. Among other economic linkages is the Walvis Bay-Ndola-Lubumbashi Development Corridor, a market topology linking Namibia, Zambia and the Democratic Republic of Congo (DRC). The significance of this development corridor is that Zambia already enjoys favourable trade balances with Namibia and DRC. Therefore, this lays a proper foundation for the country not only to scale up its trade volume with the two countries but also extend its footprints beyond Africa. However, critical to this depends on how the country essentially leverages its stable macroeconomic framework to attract the much needed private sector investment necessary to scale up production in the manufacturing value chain. The Foreign Private Investment & Perceptions Survey (2021) revealed that political stability and good governance environment are major determinants of the private sector investment influx in Zambia. Further, the expended trade volume prospects will also depend on how the country leverages its agricultural potential. Empirically, aside from having favourable weather conditions suitable for a variety of crops, Zambia accounts for about 60% of natural water bodies in southern Africa, thus, making it better positioned to circumvent different acute climate patterns on crop productivity through irrigation schemes as compared to other countries in the region. Further, the unfortunate food insecurity in the DRC establishes a natural demand for the country’s agricultural outputs, for which the supply has remained low.

Zambia exported US$1.35B to Namibia in 2020, representing a 37.7% annualised rate increase from US$2.24M in 2000. The major products included Raw Copper at US$1.15B, Refined Copper at US$126M, and Electricity at $46M. Meanwhile, Namibia exported US$226M worth of merchandise to Zambia, translating to about 28.2% annualised increase from $1.58M in 2000. The main exports included Non-Fillet Frozen Fish at US$70.9M, Acrylic Polymers at US$35.3M, and Steel Bars at US$32.1M. Regarding trade directions with the DRC, Zambia exported $952M worth of products to that country (about 15.4% annualized rate increase from $26.6M in 1995). This included Sulphuric Acid at US$96.9M, Copper Ore at US$87M, and Quicklime at US$66.7M, among others. Similarly, the Democratic Republic of the Congo exported US$372M to Zambia in 2020 (about 20% annualized rate increase from US$3.88M in 1995). The main products included Refined Copper at US$290M, Copper Ore at US$65.9M and Cobalt Oxides and Hydroxides at US$8.13M.

Therefore, for the country to fully harness and expand its export volumes with Namibia, DRC and beyond, as mentioned earlier, PMRC urges the Government to continue on a policy trajectory of maintaining stable macroeconomic frameworks for the private sector to flourish. In turn, this will advance the investment attractability of the country in key sectors such as mining and manufacturing. Further, agricultural comparativeness, which the country enjoys, should be utilized and buoyed with increased investments in crop productivity and irrigation schemes.